A Presbyterian Hunger Program Article

By Agazit Abate, Intern Scholar with the Oakland Institute

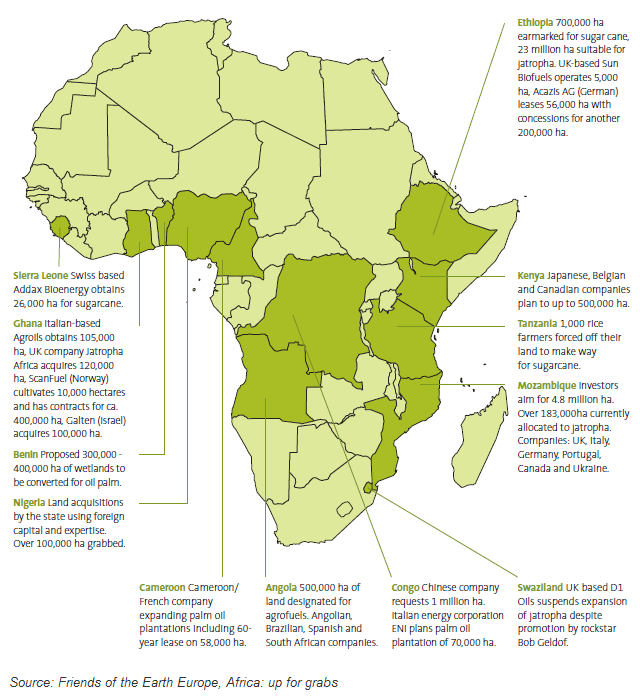

The commodification of agriculture, food, and land, spurred in part by the 2008 food and financial crisis, has led to the purchase of enormous portions of land throughout Africa. As corporations, investment firms, and outside governments realized the investment potential in agriculture, various African governments signed off on deals ushering in the phenomenon now commonly referred to as “land grab”. In 2009 alone, nearly 60 million hectares (or roughly 148,263,228 acres) of land was purchased or leased throughout the world, over 70 percent of which was in Africa, for the production and export of food, cut flowers, and agrofuel crops.

The commodification of agriculture, food, and land, spurred in part by the 2008 food and financial crisis, has led to the purchase of enormous portions of land throughout Africa. As corporations, investment firms, and outside governments realized the investment potential in agriculture, various African governments signed off on deals ushering in the phenomenon now commonly referred to as “land grab”. In 2009 alone, nearly 60 million hectares (or roughly 148,263,228 acres) of land was purchased or leased throughout the world, over 70 percent of which was in Africa, for the production and export of food, cut flowers, and agrofuel crops.

According to the Oakland Institute, a leading policy think tank which has been researching foreign land investments in Africa, Western firms, wealthy U.S. and European individuals, and investment funds with ties to major banks such as Goldman Sachs and JP Morgan have played a role in land grab along with American universities such as Harvard, Spellman, and Vanderbilt who are also taking part in these land investments. Food insecure nations are also participating in these land deals for the purpose of food production for their home countries. Of course, the biggest institutional role in land grab goes to the World Bank Group’s private section arm, the International Financial Corporation which promotes land grab through private sector funding and ‘Technical Assistance and Advisory Services’.

These largely unregulated transactions that have guarantees that they will help the local populations, create infrastructure or employment, have consequences which include decreased food security, environmental degradation, community repression and forced relocation, and increased reliance on aid.

In Ethiopia, the process of transfering land to village control in an area targeted for land investments has relocated 700,000 indigenous people. In Samana Dugu, Mali, in 2010, bulldozers came in to clear land and when the community protested, they were met by police forces who beat and arrested them. Investment sites in various African countries visited by the Oakland Institute reveal a loss of local farmland where the lands held a variety of different uses and social/ecological value.

In various countries, forests and national reserves that are home to vital animal, fish and plant species and are places where communities have found alternative sustenance in times of food scarcity, have been burned and cleared out. To compound matters, the practice of industrial agriculture leads to increased toxicity, disruption of nature’s system of pest control, creation of new weeds or virus strains, loss of biodiversity, and the spread of genetically-engineered genes to indigenous plants.

Overall, land grab spells disaster for the communities and lands targeted. As Anuradha Mittal, Executive Director of the Oakland Institute notes, “The same financial firms that drove us into a global recession by inflating the real estate bubble through risky financial maneuvers are now doing the same with the world’s food supply. In Africa this is resulting in the displacement of small farmers, environmental devastation, water loss and further political instability such as the food riots that preceded the Tunisian and Egyptian revolutions.”